Small Business Health Insurance Tax Guide: Subsidies vs. Credits vs. Deductions

Health insurance spend can be a sizable portion of many small businesses expenditures. Many businesses want to provide this employee benefit and view it as a means of attracting and keeping employees. At the same time, decreasing spend in this area and freeing up cash flow for other businesses expenses gives your small business more breathing room to operate effectively, make loan payments, and grow your business with fewer constraints.

As a small business owner, the introduction of the Affordable Care Act has created new ways for small businesses to offer coverage to employees. Each way of covering employees has different cost implications and tax implications. Understanding the different coverage options and offering the appropriate health insurance plan will ensure that your employees are properly covered while maximizing the tax benefits available to your businesses.

Three Ways For Small Businesses to Provide Health Insurance Coverage

1. Traditional Small Group Health Insurance Plan

Traditional small group health insurance plans are employer-sponsored health insurance plans that a company can offer to their employees. Companies who get traditional small group health insurance plans can choose from a wide variety of insurance carriers and plan types, and the company contribution to premiums is a tax-deductible business expense.

2. Tax Credit-Eligible Small Group Health Insurance Plan

Small businesses can also obtain small group health insurance plans through the government SHOP exchanges. There are fewer insurance carriers that offer plans through the government exchange, however qualifying businesses can obtain an additional tax credit on their premiums.

3. Subsidized Individual Plan through Government Exchange

Small businesses can also choose to not offer a group plan, and instead help employees get subsidized coverage through the government exchanges. For some small businesses, not offering employee benefits may actually be the lowest cost and best option for their employees. The biggest drawback is that any company contribution to employee premiums have to be considered taxable income, otherwise the company is subject to substantial tax penalties.

| Coverage Type | Tax Benefits | % Cost Savings from Tax Benefits | Drawbacks |

|---|---|---|---|

Traditional Small Group health Insurance Plan |

Premiums paid by the company are tax-deductible business expenses, premiums paid by employees are pre-tax contributions |

25-40% |

Not eligible for small business tax credit or subsidized individual plans |

Tax Credit-Eligible Small Group Health Insurance Plan |

Premiums paid by the company can get reduced by up to 50% through tax credits, and the rest of the premium cost is tax-deductible |

30-65% |

Fewer insurance carriers and plans to choose from |

Subsidized Individual Plan through Government Exchange |

Lower income employees qualify for subsidies on individual plans |

50-85% |

Companies cannot reimburse employees for the cost of premiums, and can only provide taxable increase in wages |

Determining the Best Coverage for Your Business

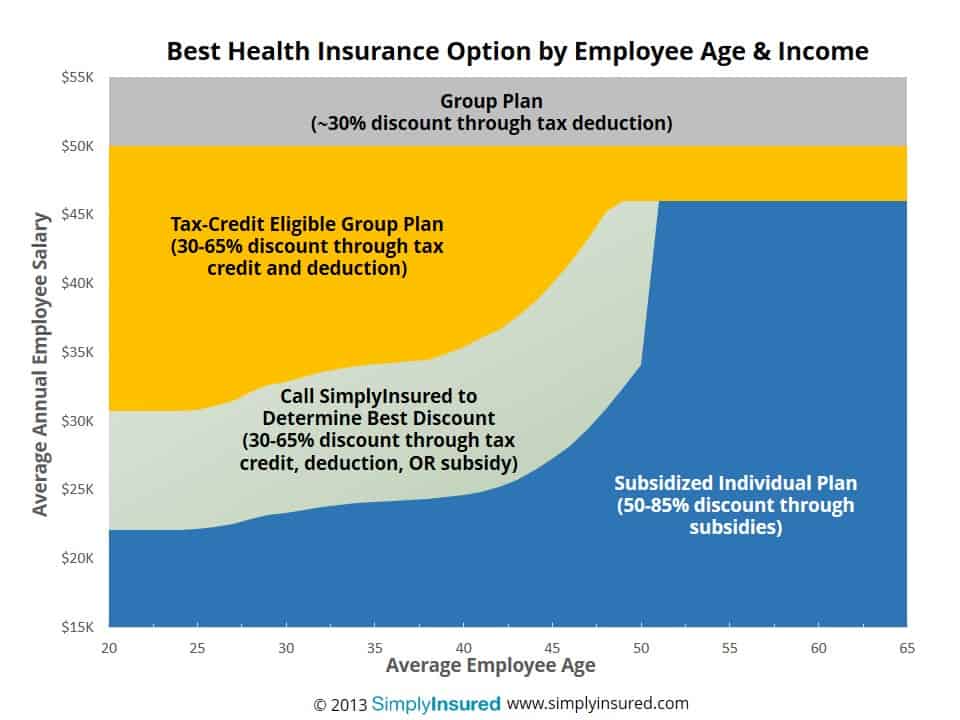

The value of the tax benefits through each method of coverage employees depends primarily on the average age and income of your employees, given the additional tax benefits available through the government exchanges.

Traditional Small Group Health Insurance Plans are best for companies with:

- Employee wages above $50K, OR

- Company size of more than 25 employees

Tax Credit-Eligible Small Group Health Insurance Plans are best for companies with:

- Fewer than 25 full-time employees

- Average annual salaries between $30K-$50K

- Average employee age under 40

Subsidized Individual Plans through Government Exchange are best for companies with:

- Employees earning less than $30K/year

- Older employees earning less than $46K/year

| Coverage Type | Average Age | Average Income | Company Size |

|---|---|---|---|

Traditional Small Group health Insurance Plan |

Any age |

Best for companies with higher income workers; $50K+/year |

Any company 2-50 employees in 2015; 2-100 in 2016 |

Tax Credit-Eligible Small Group Health Insurance Plan |

Best for companies with younger employee base; e.g. 40 and younger |

Best for companies with average annual income between $30-50K/year |

25 and fewer employees |

Subsidized Individual Plan through Government Exchange |

Best for companies with older employee base; e.g. 50 and older |

Best for companies with lower than average annual income; less than $30K/year |

Any company under 50 employees |

Knowing the best approach to health insurance for your company will ensure that you maximize the benefits available to your employees without breaking your budget.

Source: Kaiser Family Foundation Health Insurance Marketplace Calculator (http://kff.org/interactive/subsidy-calculator/)

DISCLAIMER: This content is for informational purposes only. OnDeck and its affiliates do not provide financial, legal, tax or accounting advice.

Find the right funding for your business.

Term loans up to $250K. Lines of credit up to $100K.

No obligations and no hard credit pulls.