A Guide to OnDeck Business Credit Reporting

Understanding your business credit profile

A key measure of your business’ financial health is your business credit profile. We want you to get the most from your OnDeck relationship by helping you understand and manage your business’ credit profile.

Since your credit profile describes how your business interacts with creditors (including online lenders), loan payments to OnDeck help tell one part of that story. A positive payment history can have a huge impact on your business credit profile over time, potentially improving your business’ profile and lowering your perceived credit risk.

If you’d like to learn more about business credit, check out our article, “Understanding Business Credit.”

Accessing your business credit report

We report information about your business term loan payment status to three nationwide business credit bureaus every month: Experian, Equifax, and Paynet.[1] We report information about your business line of credit to Experian on a monthly basis. Items reported include payment amounts, outstanding balance, past due payments, and other account activity.

This is important because your prompt payments and good credit history with OnDeck will reflect positively on your business credit profile.

You have the option of accessing your business’ report directly from the bureaus—either on a one-time or ongoing basis depending on your needs (procuring reports from one bureau may be sufficient). This is an important step to ensure your business credit profile is an accurate representation of your business credit behavior. Regularly monitoring your profile is recommended.

While you have the right to a free personal credit report once every 12 months, a fee is typically charged for business credit reports. Your most recent report should typically be available to you by the end of the current month for the previous month (e.g., May report is available end of June).

To access your report, visit:

Experian (Term Loan and Line of Credit): http://www.experian.com/small-business/business-credit-reports.jsp

Paynet (Term Loan only): http://www.paynetonline.com/issues-and-solutions/all-paynet-products/credit-history-report/

We also provide Monthly Statements for your term loan, which reflect your principal and interest payments. You can find statements in your OnDeck online account in the “Documents” tab.

Reviewing your business credit report

Your loan with OnDeck is represented as a “tradeline” of credit on your business credit report. When reviewing the report, however, our tradeline won’t be displayed as “OnDeck.” This is because the bureaus do not specify the names of lenders on business credit reports for privacy reasons, unlike on consumer credit reports.

There are some similarities in the way each bureau displays information, as well as some differences. You might see variations in layout, naming conventions, and even level of account detail provided. For example, although we report loan payment amounts to all three bureaus, only Paynet displays the actual payment amount, while Experian and Equifax just display loan balance. All bureaus indicate whether or not payments are past due or delinquent.

The best way to identify your OnDeck tradeline is to review the “balance” or “outstanding balance” listed in the tradeline, and then compare it to what your current balance is with OnDeck at the point in time the tradeline indicates. You can find your current OnDeck term loan balance in the Monthly Statement or your OnDeck online account. For lines of credit, you can find your current balance on the home page of the online account.

Once you’ve accessed your report and identified the current/outstanding balance, you can review our guide below on how to decipher your report details, along with examples of what each bureau’s report looks like.

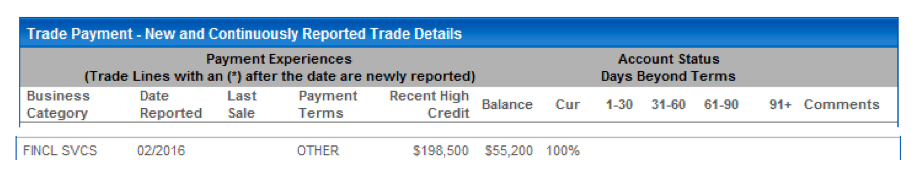

Experian

Key fields to review:

- OnDeck tradeline: find under the “Trade Payment” > “Business Category” > “FINCL SVCS” section

- Payment Terms: your daily or weekly payment schedule will be listed as “Other”

- Recent High Credit: highest account balance with OnDeck in the last 12 months

- Balance: outstanding balance with OnDeck

- Cur: 100% if account has a current status (not past due)

- Days Beyond Terms: average number of days payment is past due

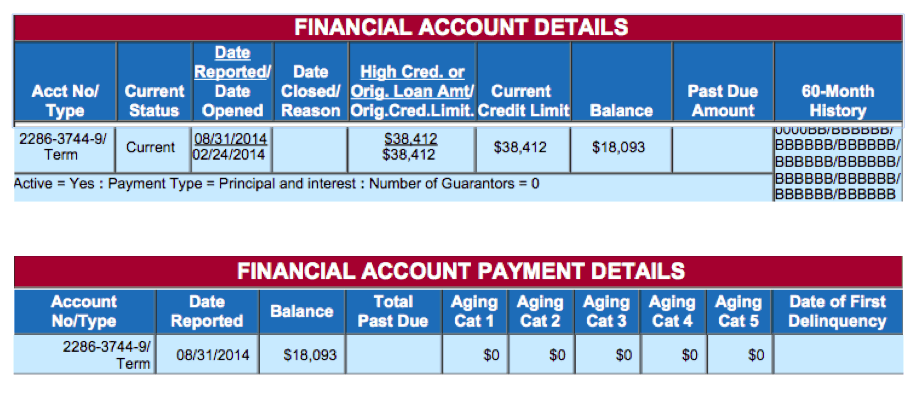

Equifax

Key fields to review:

- OnDeck tradeline: find under “Financial Account Details” > “Account No/Type” section

- Details financial accounts with a date reported or closed within 24 months of inquiry

- Account No./Type: to help differentiate account, tradelines are given a randomized identifier; your OnDeck tradeline will always have the same identifier

- Current Status: overall payment performance status for the month; some common statuses include: “Current,” “Account closed,” “Slow up to 30,” and “Slow up to 60”

- Date Reported/Date Opened: date of most recent data submission / date loan closed

- High Cred. or Orig. Loan Amt/Orig. Credit. Limit: highest loan amount report, original loan amount, or original credit limit

- Balance: total reported balance including any past due amount

- Past Due Amount: total past due from each aging category (1-30 days, 31-60 days, 61-90 days etc.)

- 60-Month History: shows consecutive payment performance, listed as a letter code, for the 60 months prior to the most recent date reported; “B” is unknown, “C” is account closed, “0” is current, “S” is slow, 1 is Slow up to 30 days, “2” is Slow up to 60 days, “3” is Slow up to 90 days, “4” is Slow up to 120 days, “5” is Slow 121+ days, “6” is Collection and “9” is Charge-off

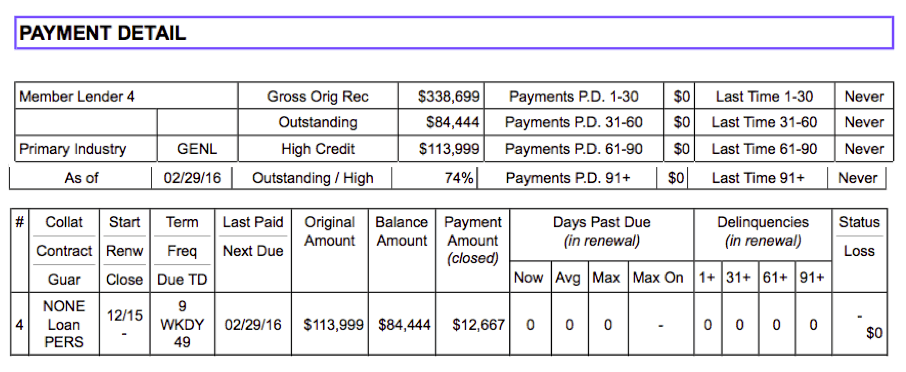

Paynet

Key fields to review:

- OnDeck tradeline: find under “Payment Detail” > “Member Lender” section

- Identifies the member as a pseudonym with a number

- Gross Orig Rec: gross original receivable amount

- Outstanding: current balance amount

- High Credit: highest ever current balance amount

- Payments P.D.: amount past due for each delinquency category e.g., 1-30, 31-60 etc.

- Primary Industry: OnDeck is “GENL” for general

- As of: date lender most recently reported to Paynet

- Outstanding / High: current loan balance as percentage of highest ever current balance

- Collat / Contract / Guar:

- Collateral related to loan contract

- Contract type

- Guarantor for contract; “pers” is personal

- Start / Renw / Close:

- Start date of contract

- Renewal date of contract

- Close date of contract

- Term / Freq / Due TD:

- Term in months

- Payment frequency DAY (daily), WKDY (week day M-F), WEEK (weekly)

- Last Paid / Next Due:

- Most recent date lender reported receiving payment

- Next due: if days past due is greater than zero, this is the date of the oldest unpaid payment in the past; otherwise, this is the date of the next payment due in the future

- Original Amount: original receivable for contract

- Balance Amount: current balance (same as “Outstanding”)

- Payment Amount: total payment amount for the reporting period, which is the original amount divided by the term adjusted for payment frequency

- Status / Loss:

- Indicates derogatory condition of contract; possible values are: “-“ (N/A), “COLL” (collection process initiated or completed), “BNKR” (bankruptcy), “LEGL” (legal process initiated or completed) etc.

- Amount lost or written off by lender

Disputing your business credit report

If you have reviewed your report and believe there are errors you wish to dispute, the bureaus require business owners to go through a dispute resolution process online. Fortunately, because the credit bureaus want to have accurate information, they are all motivated to correct any verifiable errors.

To inquire about items in your report or submit a dispute, you will first need a copy of your business credit report, which can be started here:

Experian Commercial Credit Services

- First, go to http://sbcr.experian.com/main.aspx to get your credit report

- Next, you will need to submit a dispute, which can be found here: https://www.experian.com/small-business/business-credit-information.jsp

- Phone: (888)-211-0728

- Email: BusinessDisputes@experian.com

Equifax Business Customer Support

- Phone: (866)-349-5191

Paynet

- Phone: 866-825-3400

- Email: support@paynetonline.com

If you have any further questions about business credit reports, please contact your dedicated account manager. We can also help ensure that your secretary of state filings are in good standing, review the benefits of incorporating, and more.

[1] Reporting starts two months after you become an OnDeck customer.

Suggested Articles for Your Reading Pleasure:

21 Terms Your Should Know Before Applying for Financing

Your Ultimate Guide to Small Business Financing

Use Small Business Credit to Fuel Your Growth | Podcast Interview

DISCLAIMER: This content is for informational purposes only. OnDeck and its affiliates do not provide financial, legal, tax or accounting advice.

Find the right funding for your business.

Term loans up to $250K. Lines of credit up to $100K.

No obligations and no hard credit pulls.